25+ Ct Taxes Calculator

FUTA is an annual tax an employer pays on the first 7000 of each employees wages. Select Your State Deduction Method.

2016 Estate Tax Rates The Motley Fool

Web Tax Calculation Schedule.

. Filing 25000000 of earnings will result in 5454700 of that amount being taxed as federal tax. Rates begin at 116 for the first 1 million above the exemption. Web Enter your employment income into the paycheck calculator above to estimate how taxes in Connecticut USA may affect your finances.

2021 2022 2023 2024. Web The Connecticut Salary Calculator updated for 2023 allows you to quickly calculate your take home pay after tax commitments including Connecticut State Tax Federal State Tax Medicare Deductions Social Security with Connecticut state tax tables. Calculate your tax liability instantly by visiting myconneCT at Individuals on the myconneCT homepage select View Tax Calculators then select Income Tax Calculator.

Web Calculating your Connecticut state income tax is similar to the steps we listed on our Federal paycheck calculator. Web Your required annual payment for the 2023 taxable year is the lesser of. Deduct the amount of tax paid from the tax calculation to provide an example of your 202425 tax refund.

It has been specially developed to provide. Web Connecticut Salary Tax Calculator for the Tax Year 202324. Web First the 2022 exemption amount in Connecticut is 91 million.

Select the filing status as checked on the front of your tax return and enter your Connecticut Adjusted Gross Income AGI. When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Web PENSION OR ANNUITY WITHHOLDING CALCULATOR.

This state does not have StandardItemized Deductions. Estimate your tax liability based on your income location and other conditions. The 2021 credit can be up to 6728 for taxpayers with three or more children 6935 for tax year 2022 or lower amounts for taxpayers with two one or no children.

Enter Connecticut Adjusted Gross Income AGI from Form CT-1040 Line 5 or Form. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Web After entering it into the calculator it will perform the following calculations.

You are able to use our Connecticut State Tax Calculator to calculate your total tax costs in the tax year 202324. There are seven tax brackets that range from 300 to 699. Web Like the state the federal government also has an unemployment tax called FUTA which is paid by employers.

Use this calculator to determine your Connecticut income tax. Web Use ADPs Connecticut Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Connecticut.

Your average tax rate is 1167 and your. Youll then get your estimated take home pay an estimated breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to possibly expect when. Enter your withholding code from Form CT-W4P Line 1 and your monthly pension or annuity amount before any reductions.

Web Use our income tax calculator to estimate how much tax you might pay on your taxable income. This calculator is intended to be used as a tool to calculate your monthly Connecticut income tax withholding. Monthly Connecticut Withholding Calculator - CT-W4P.

Calculate your total tax due using the CT tax calculator update to include the 202425 tax brackets. 100 of the income tax shown on your 2022 Connecticut income tax return if you filed a 2022 Connecticut income tax return that covered a 12month period. Work out your adjusted gross income Net income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Exemptions Taxable income.

Updated on Jul 18 2023. Web Overview of Connecticut Taxes. Select Your Filing Status.

Connecticut has a set of progressive income tax rates meaning how much you pay in taxes depends on how much you earn. Overview of Federal Taxes. The following calculators are available from myconneCT.

Click here to view the Tax Calculators now. Calculate your 2023 Connecticut state income taxes. Web The list below describes the most common federal income tax credits.

Curious about much you will pay in Connecticut income tax. Web A single filer in Connecticut will take home 5621850 with a total income tax of 1778150. Property Tax Credit Calculator.

Web 202425 Connecticut State Tax Refund Calculator. If you make 70000 a year living in California you will be taxed 11221. Web California Income Tax Calculator 2022-2023.

The top rate is 12 for the portion of any estate that exceeds 101 million in value. Social Security Benefit Adjustment Worksheet. Residents of Connecticut dont have to pay local taxes as there are no cities or towns in the state that charge their own income taxes.

Your tax is 0 if your income is less than the 2022-2023 standard deduction determined by your. Web Need help calculating paychecks. The FUTA rate for 2023 is 60 but many employers are able to pay less for instance up to 54 each year due to tax credits.

Estates with a taxable value above 91 million must pay the estate tax. Use our paycheck tax calculator. - FICA Social Security and Medicare.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Web The Connecticut income tax system has six different brackets starting at 3 and going up to 699.

Single Head of Household Married Filing Joint Married Filing Separately Surviving Spouse. Web STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES 2021 INCOME TAX CALCULATOR PURPOSE. The Connecticut State Tax calculator is updated to include.

Use the Connecticut paycheck calculator to find out. Web Connecticut Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. Is a refundable credit for taxpayers with income below a certain level.

Figure out your filing status. Web Select a Tax Year. 90 of the income tax shown on your 2023 Connecticut income tax return.

Filing 25000000 of earnings will result in 1400740 being taxed for FICA purposes.

Connecticut Salary After Tax Calculator 2024 Icalculator

Source Jumbo Electronic Calculator With Tax Function Accountant Electronic Calculator On M Alibaba Com

![]()

Cointracking On The App Store

Sales Tax Calculator

Hp 17bii Financial Calculator 22 Digit Lcd Walmart Com

Source 12 Digits Electronic Tax Calculator Ct 555 On M Alibaba Com

5 Tax Rates Per Country In 2003 Download Table

Corporation Tax Calculator And Dates Money Donut

Connecticut Sales Tax Calculator Reverse Sales 2023 Dremployee

Texas Instruments Ti 84 Plus Ce T Python Edition Graphical Calculator Colour Display Black Amazon De Stationery Office Supplies

Connecticut Hourly Paycheck Calculator Ct 2023 Tax Rates Gusto

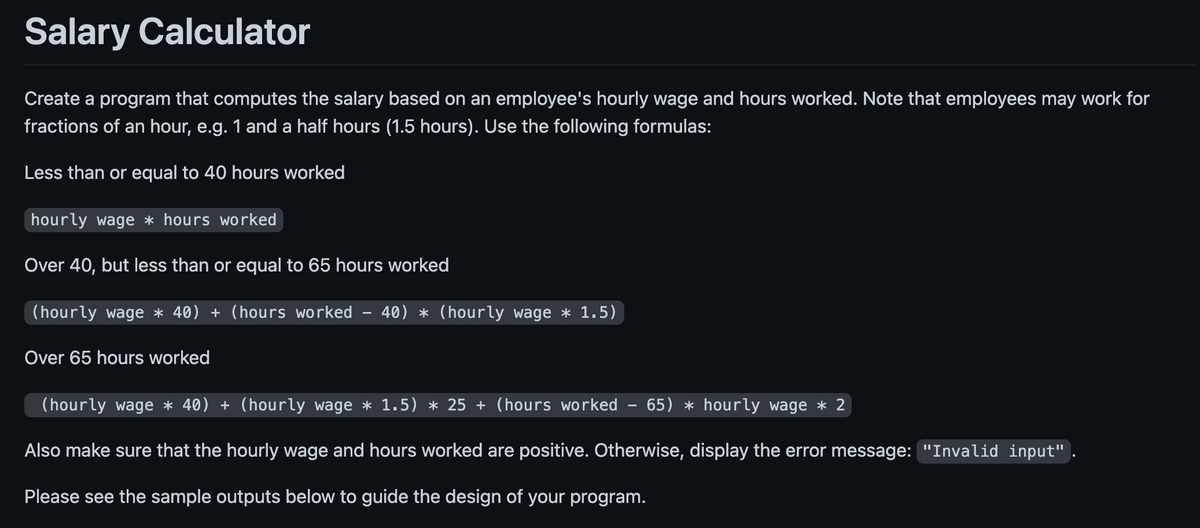

Answered Salary Calculator Create A Program That Bartleby

Rental Property Income Tax Calculator Mynd

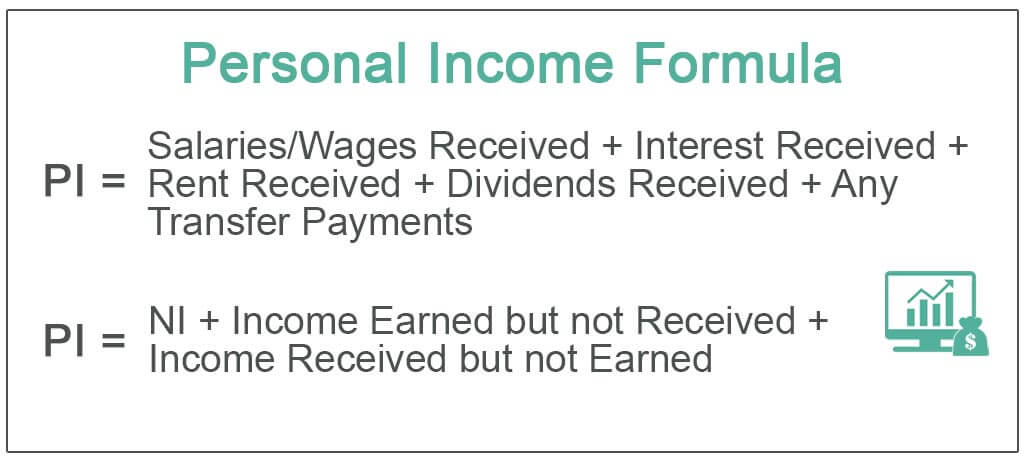

Personal Income What Is It Formula How To Calculate

Home Tax Preparation At The Boston Agency In Meridian Ms

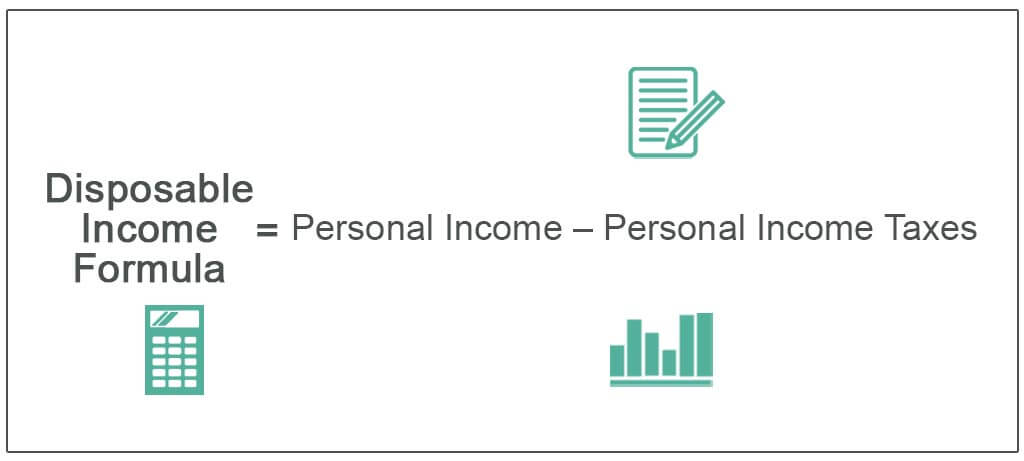

Disposable Income Formula Step By Step Calculation

Gst Calculator Tax Calculator